Houston Retailers: How to Finance Inventory Ahead of Holiday Sales Surges

Home » Help Articles » Houston Retailers: How to Finance Inventory Ahead of Holiday Sales Surges

Houston Retailers: How to Finance Inventory Ahead of Holiday Sales Surges

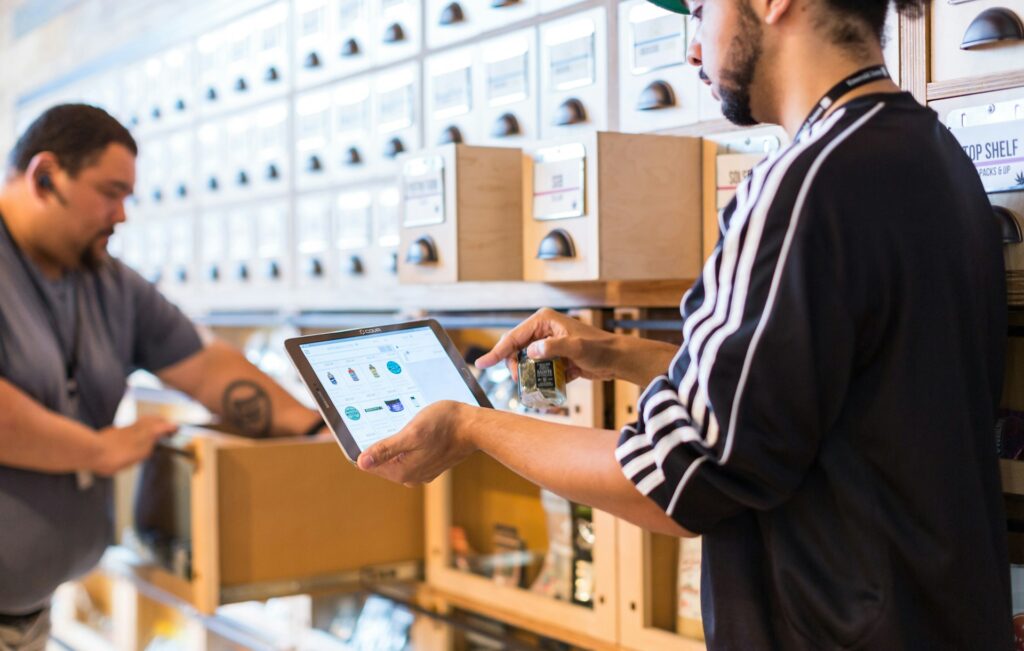

For Houston retailers, the holiday season is one of the most profitable times of the year. From shoppers in the Galleria area to local boutique stores across the city, increased demand can mean higher sales — but only if you have enough inventory to meet customer needs.

Many retailers struggle to stock up for the holidays due to cash flow limitations. That’s where inventory financing and working capital solutions come in. Accessing funding ahead of the holiday rush ensures your store is fully prepared to maximize sales opportunities.

1. Understand Your Holiday Inventory Needs

Start by assessing your projected sales and inventory requirements:

- Which products are expected to be best-sellers?

- How much stock will you need to meet peak demand?

- Are there seasonal items or gift bundles to offer?

Having a clear plan helps determine how much funding you’ll need to cover inventory purchases.

2. Explore Inventory Financing Options

There are several ways Houston retailers can secure funds to purchase inventory:

- Working Capital Loans: Quick access to funds for stocking merchandise and covering operational expenses.

- Short-Term Business Loans: Ideal for temporary cash flow needs during the holiday season.

- Business Lines of Credit: Flexible funding that can be used as needed and repaid on your schedule.

Providers like Viking Funding specialize in fast, reliable financing that helps retailers stay stocked and competitive.

3. Take Advantage of Supplier Discounts

Early funding allows retailers to buy inventory in bulk or secure early-order discounts. Benefits include:

- Lower per-unit costs

- Priority delivery for high-demand items

- Reduced risk of stockouts during peak shopping days

Financing ahead of time ensures your store is ready for the holiday rush while improving profit margins.

4. Fund Seasonal Marketing and Staffing

Inventory alone isn’t enough to guarantee high sales. Retailers can use financing to:

- Run targeted marketing campaigns online and locally

- Offer seasonal promotions and holiday deals

- Hire additional staff to manage increased foot traffic

Combining inventory financing with marketing and staffing investments maximizes revenue potential.

5. Plan for Post-Holiday Sales

Having excess inventory after the holidays can tie up cash flow. Strategic financing allows retailers to:

- Purchase the right amount of stock without overextending

- Prepare for clearance or post-holiday promotions

- Maintain financial flexibility for January operations

This ensures your business can transition smoothly into the new year without financial strain.

Final Thoughts

Holiday sales surges can make or break a retail year in Houston. By securing inventory financing and working capital ahead of time, retailers can stay fully stocked, attract customers, and maximize profits during the busiest shopping season.

For Houston retailers looking for fast and flexible funding, Viking Funding offers solutions that help your business thrive through the holidays and beyond.

Why Choose Viking Funding?

Fast & Flexible

Perfect for businesses that need fast cash for 3-24 months with high approval rates and the best terms.

Founded by Industry Professionals

Our specialized focus on Merchant Cash Advances (MCAs) sets us apart. We keep our deep understanding of small business challenges with our passion for helping entrepreneurs thrive.

Incredible Service

Our dedicated team is passionate about helping you navigate the ever-changing business landscape, providing ongoing support and guidance whenever you need it.

A Reputation You Can Trust

★★★★★

Frequently Asked Questions

Viking Funding offers a diverse range of financing options for business owners across the nation. We specialize in Revenue Based Financing, where businesses can borrow based on their monthly revenue. Additionally, we provide business lines of credit, business term loans, and SBA Loans, tailored to meet the specific needs of your business.

Viking Funding works with businesses in all industries, understanding that each sector has unique challenges and financing requirements. Whether you’re in manufacturing, retail, services, or any other industry, we have the expertise to support your business goals.

The qualification requirements vary by the type of financing:

Revenue Based Financing: At least 6 months in business, a business checking account, and 4 months of bank statements showing an average revenue of at least $20,000 per month.

Business Lines of Credit, Term Loans, and SBA Loans: A personal credit score of 550 or above is required, along with the last 2 years of most recent tax returns for the business, a profit and loss statement, and a balance sheet.

Why Wait?

Get Started with

Viking Funding Today!